How much do banks lend for mortgages

We Offer Competitive RatesFees Online Conveniences - Start Today. Ad Todays Best Mortgage Lenders By Rates Service.

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

Want to Know How to Choose a Mortgage Lender.

. Compare Quotes See What You Could Save. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. For a reverse mortgage they could run as much as 15000.

Trusted by 1000000 Users. We Offer Competitive RatesFees Online Conveniences - Start Today. They occur when a number of these loans often with the same characteristics are brought together.

Apply Online Get Pre-Approved Today. In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a house loan for the purpose of purchasing. How much do banks usually lend for mortgages Sabtu 03 September 2022 Edit.

DTI Often Determines How Much a Lender Will Lend. Mortgage calculator Find out how much you could borrow. Compare Best Lenders Apply Easily.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. The interest is 6 which incorporates the lender borrowing the funds at 4 interest and extending a mortgage at 6 interest meaning the lender earns 2 in interest on the loan. How Much Does an Appraisal Cost.

42000 of gross. Bank Has Loan Officers To Personally Guide You Through the Home Mortgage Process. A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

Apply Now With Quicken Loans. How income multiples affect your borrowing chances. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan but your monthly payment will be considerably more.

36000 of gross income less fixed monthly expenses. Bank Has Loan Officers To Personally Guide You Through the Home Mortgage Process. Lock Rates For 90 Days While You Research.

The average appraisal costs about 400 but that figure varies depending on the size and value of the home appraisals typically cost more for larger. 28000 of gross income or. Four components make up the mortgage payment which are.

Ad Compare Best Mortgage Lenders 2022. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. Compare Quotes Now from Top Lenders.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. The size of the loan versus the property value is. Banks are allowed to lend out 90 of.

This frees up another 300000 to 30 million for. Looking For A Mortgage. For this reason our.

Lender A gives you a 300000 mortgage loan. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Banks and building societies will usually lend a maximum of four-and-a-half times the total annual income of you and anyone else youre.

For example a mortgage. Its A Match Made In Heaven. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments.

A general rule is that these items should not exceed 28 of the borrowers gross. Were not including any expenses in estimating the income you need for a. Were Americas 1 Online Lender.

Medium Credit the lesser of. Ad Compare Mortgage Options Calculate Payments. Mortgages called MBS are mortgages and other mortgages.

Ad Make Homeownership a Reality Choose From One of Our Affordable Mortgage Programs. Is an adjustable-rate mortgage a better option for. Lender A sells that loan either alone or with 100 other similar ones to Investor B.

In most cases you will need a minimum of a 5 deposit to secure a mortgage meaning youll need a 95 mortgage loan. Ad Find Mortgage Lenders Suitable for Your Budget. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

36000 of gross income or. Get Your Best Interest Rate for Your Mortgage Loan. This mortgage calculator will show how much you can afford.

Dont Settle Save By Choosing The Lowest Rate. Good Credit the lesser of. Interest principal insurance and taxes.

Mortgage Document Checklist What You Need Before Applying For A Mortgage

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Real Estate Tips

Design Eye Catching Independent Mortgage Broker Brochure Brochure Contest Winning Design Brochure Alan Mortgage Brokers Mortgage Brochure

At E Mortgage Capital Our Approach To Business Is As Simple As It Comes It Revolves Around The Sati Mortgage Mortgage Protection Insurance Refinance Mortgage

7 Things You Didn T Know About Australian Mortgages Mortgage Brokers Mortgage Tips Mortgage

New Home Purchases Are The Main Driver Of Mortgage Debt Cmhc

Ryan Wiley Business Card Burlington On Mortgage Brokers Mortgage Brokers Mortgage Home Mortgage

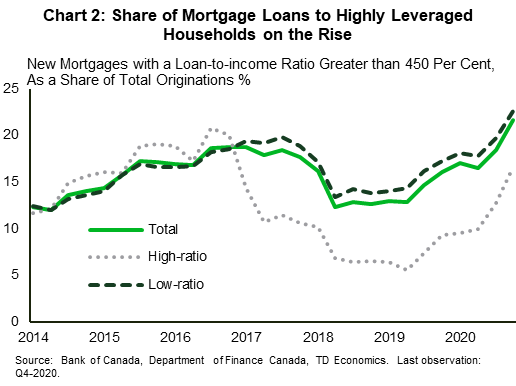

The Pandemic Sprint Into Mortgages A Look Into The Risks That Have Tagged Along For The Ride

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Interesting Points Even If It Is Canadian Data Very Similar Figures For Australian Consumers I Suspect Refinance Mortgage Mortgage Marketing Mortgage Tips

Td Bank Fixed And Variable Mortgage Rates Sep 2022 Special 2 74 Wowa Ca

Chip Reverse Mortgage Rates Homeequity Bank

Average Mortgage Loan Canada 2021 Statista

What You Should Know When Shopping For A Mortgage Home Buying Mortgage Real Estate Advice

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer